Unlocking Your Dream Ride: The Ultimate Guide to Trucks For Sale Monthly Payments

Unlocking Your Dream Ride: The Ultimate Guide to Trucks For Sale Monthly Payments Lmctruck.Guidemechanic.com

Embarking on the journey to purchase a truck is exciting, whether you need a workhorse for the job site, a dependable vehicle for family adventures, or simply love the power and presence a truck offers. However, for many buyers, the most significant hurdle isn’t choosing the perfect model, but rather understanding and managing the financial commitment. Specifically, comprehending trucks for sale monthly payments is paramount to making a smart, sustainable decision.

This comprehensive guide is designed to empower you with all the knowledge you need. We’ll delve deep into the mechanics of truck financing, reveal strategies to secure the best deals, and equip you with the insights of an industry veteran. Our goal is to transform what can be an intimidating process into a clear, confident path toward owning your ideal truck without financial strain.

Unlocking Your Dream Ride: The Ultimate Guide to Trucks For Sale Monthly Payments

Why Understanding Monthly Payments is Absolutely Crucial

Focusing solely on the sticker price of a truck can be misleading. The actual financial impact on your budget comes down to the monthly payment. This recurring expense dictates your day-to-day affordability and long-term financial health.

A payment that seems manageable initially might conceal hidden costs or an unfavorable loan structure. Conversely, a higher-priced truck could have a surprisingly affordable monthly payment with the right financing. Understanding these nuances protects you from buyer’s remorse and ensures your truck remains a joy, not a burden.

The Key Factors Shaping Your Truck’s Monthly Payment

Numerous variables converge to determine the exact amount you’ll pay each month. Grasping each of these components is the first step toward gaining control over your truck financing. Let’s break them down in detail.

1. The Vehicle’s Price: New Versus Used

Naturally, the total price of the truck is the biggest single factor. Brand-new trucks come with the latest features, warranties, and often higher price tags. This translates directly into higher loan amounts and, consequently, larger monthly payments.

Used trucks, on the other hand, offer significant savings due to depreciation. A well-maintained used truck can provide excellent value and a much more palatable monthly payment. Based on my experience, many buyers find incredible deals by exploring certified pre-owned options. For a deeper dive into choosing between new and used vehicles, check out our guide on .

2. Your Down Payment Amount

The down payment is the initial sum of money you pay upfront for the truck. This amount directly reduces the total sum you need to borrow. A larger down payment means a smaller loan principal, leading to lower monthly payments and often less interest paid over the life of the loan.

Pro tips from us: Aim for at least 10-20% of the truck’s purchase price as a down payment. This not only lowers your monthly obligation but also signals to lenders that you are a serious and responsible borrower. It can even help you secure a better interest rate.

3. The Loan Term (Length of Loan)

The loan term refers to the duration over which you agree to repay the loan, typically expressed in months (e.g., 60, 72, 84 months). A longer loan term will spread the total cost over more payments, resulting in lower individual monthly payments. However, this often comes with a significant trade-off.

While a longer term makes payments more affordable, you will almost always pay more in total interest over the life of the loan. Conversely, a shorter loan term means higher monthly payments but less interest paid overall and faster ownership. It’s a delicate balance between affordability now and total cost later.

4. The Interest Rate (APR)

The interest rate, or Annual Percentage Rate (APR), is essentially the cost of borrowing money. It’s expressed as a percentage of the loan amount. A lower interest rate means less money added to your principal, resulting in lower monthly payments and substantial savings over the loan’s duration.

Even a small difference in APR can translate into hundreds or thousands of dollars saved. This is why shopping around for the best interest rate is one of the most impactful strategies for reducing your monthly payment. Don’t underestimate its power.

5. Your Credit Score Impact

Your credit score is a numerical representation of your creditworthiness. Lenders use it to assess the risk of lending money to you. A higher credit score (typically 700+) indicates a lower risk, making you eligible for the most favorable interest rates.

Conversely, a lower credit score might lead to higher interest rates to compensate lenders for the perceived risk. It’s critical to know your credit score before you begin truck shopping. Taking steps to improve your credit before applying for a loan can save you a considerable amount of money.

6. Additional Costs: Taxes, Fees, and Insurance

Beyond the truck’s price and interest, several other costs factor into your overall financial commitment. Sales tax, registration fees, and documentation fees are often rolled into the total loan amount, increasing your principal. These are unavoidable and vary by state and locality.

Furthermore, lenders typically require full-coverage insurance on financed vehicles. While insurance isn’t usually part of the monthly loan payment, it’s a significant recurring cost directly tied to vehicle ownership. Always factor insurance premiums into your overall monthly budget when considering a truck purchase.

Navigating Your Truck Financing Options

The market offers a variety of avenues for securing a loan. Each has its own advantages and disadvantages. Exploring all possibilities ensures you find the financing solution that best fits your needs.

1. Traditional Bank Loans

Major banks are a common source for auto loans. They often offer competitive rates, especially if you have an existing relationship with them. It’s a good practice to get pre-approved through your bank before stepping into a dealership.

This pre-approval gives you a strong negotiating tool and a clear understanding of your budget. You walk into the dealership with your own financing already secured, allowing you to focus purely on the truck’s price.

2. Dealership Financing

Most truck dealerships offer in-house financing or work with a network of lenders. This can be convenient, as you complete the purchase and financing in one location. Dealerships might also offer special promotions, such as low-interest rates or rebates on specific models.

However, always compare dealership offers with independent pre-approvals. Sometimes, the convenience comes at a higher interest rate, or the dealership might mark up the interest rate from their lending partners.

3. Credit Unions

Credit unions are member-owned financial institutions known for their customer-centric approach. They often provide highly competitive interest rates and flexible terms, especially for members. It’s worth exploring if you qualify for membership in a local credit union.

Their rates can sometimes beat those offered by larger banks. This is a common pro tip from financial advisors, as credit unions prioritize member benefits over shareholder profits.

4. Online Lenders

The digital age has brought forth numerous online lenders specializing in auto loans. These platforms offer convenience, quick approvals, and often competitive rates, as they have lower overhead costs. Many allow you to compare offers from multiple lenders simultaneously.

However, always ensure you’re dealing with reputable online lenders. Read reviews and verify their credentials before sharing personal financial information. A quick search can reveal trusted names in the online lending space.

5. Leasing vs. Buying: A Brief Comparison

While this article focuses on ownership, it’s worth briefly mentioning leasing. Leasing a truck means you essentially rent it for a set period, typically 2-4 years, with lower monthly payments than purchasing. You don’t own the truck and have mileage restrictions.

Buying, on the other hand, means you own the truck once the loan is paid off. You have no mileage limits and can customize it as you wish. Choosing between the two depends on your long-term needs, financial goals, and how often you like to change vehicles.

Calculating Your Potential Monthly Payment

Before you even set foot on a dealership lot, it’s wise to have a clear idea of what you can afford. Fortunately, calculating potential monthly payments is easier than ever.

Using Online Calculators

The most straightforward way to estimate your payment is through online auto loan calculators. You can input the truck’s price, your down payment, the desired loan term, and an estimated interest rate. You can use reputable online loan calculators from sites like or major bank websites to get precise estimates.

These tools instantly provide an estimated monthly payment. Experiment with different scenarios (e.g., a larger down payment, a longer term) to see how they impact your affordability.

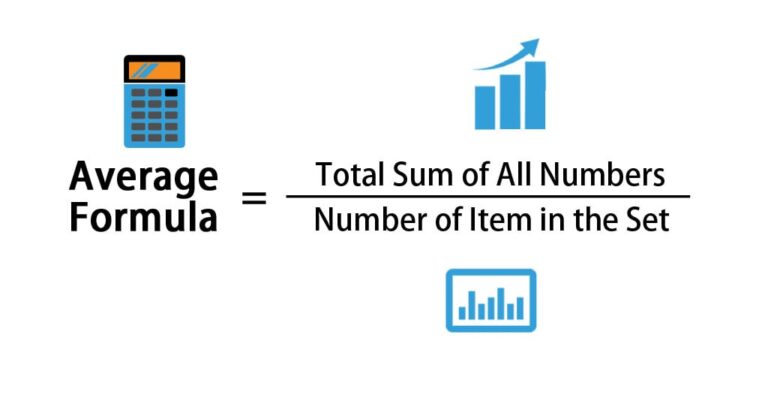

Manual Estimation (The Basic Idea)

While online calculators are precise, understanding the basic concept helps. Roughly, your monthly payment is calculated by dividing the total amount borrowed (truck price minus down payment) plus the total interest, by the number of months in the loan term.

It’s more complex with compounding interest, but this simple mental math gives you a ballpark. Always remember that interest accrues on the remaining principal, so early payments are heavily weighted toward interest.

Budgeting Before You Buy: A Pro Tip

Based on my experience, a common mistake is to figure out your budget after falling in love with a truck. Instead, determine your comfortable monthly payment first. Factor in all your other expenses, savings goals, and discretionary spending.

Once you have a firm monthly payment ceiling, work backward with a loan calculator to see what truck price you can afford. This prevents emotional overspending and ensures your truck fits comfortably into your financial life.

Smart Strategies to Lower Your Monthly Truck Payment

Even if your initial calculations seem high, there are several effective strategies you can employ to bring those trucks for sale monthly payments down to an affordable level.

1. Increase Your Down Payment

This is perhaps the most direct and impactful method. Every dollar you put down reduces the amount you need to finance. A larger down payment translates directly into a smaller loan principal, which means lower monthly payments and less interest over time. Start saving early if you know a truck purchase is on the horizon.

2. Improve Your Credit Score

As discussed, a higher credit score unlocks lower interest rates. If you have time before your purchase, focus on paying bills on time, reducing existing debt, and correcting any errors on your credit report. Even a few points increase can significantly reduce your APR.

3. Shop Around for Rates

Don’t settle for the first loan offer you receive. Contact multiple banks, credit unions, and online lenders to compare their interest rates and terms. Getting pre-approved from several sources allows you to pick the best deal. This competitive shopping can save you thousands over the loan’s life.

4. Consider a Used Truck

Opting for a used truck, especially one that’s a few years old, can drastically reduce the purchase price. Since depreciation is steepest in the first few years, you get more truck for your money. This directly lowers your loan amount and, consequently, your monthly payment.

5. Extend the Loan Term (With Caveats)

While a longer loan term reduces monthly payments, it’s a double-edged sword. You’ll pay more interest over time. Use this strategy cautiously and only if absolutely necessary to meet your budget. Always calculate the total cost over the entire term to understand the full financial impact.

6. Trade-in Your Old Vehicle

If you have an existing vehicle, using it as a trade-in can function like a down payment. The value of your trade-in is deducted from the new truck’s price, reducing the amount you need to finance. Be sure to research your vehicle’s trade-in value beforehand. And if you’re curious about maximizing your trade-in value, we’ve got an article on .

Common Mistakes to Avoid When Financing a Truck

Based on my experience helping countless buyers, certain pitfalls consistently trip people up. Avoiding these common errors will ensure a smoother, more financially sound truck purchase.

1. Focusing Only on the Monthly Payment

This is perhaps the biggest mistake. A low monthly payment might sound appealing, but it often hides a very long loan term or a high interest rate, leading to a much higher total cost of ownership. Always look at the bigger picture: the total amount you will pay over the life of the loan.

2. Ignoring the Total Cost of Ownership

Beyond the monthly payment, remember to factor in fuel costs, maintenance, potential repairs, and insurance. A powerful truck might have a great monthly payment, but if it gets terrible gas mileage and requires expensive parts, your overall budget could suffer.

3. Not Getting Pre-Approved

Walking into a dealership without pre-approved financing puts you at a disadvantage. You lose your negotiating power on the interest rate. Get pre-approved first; it sets a baseline and shows the dealer you’re a serious, informed buyer.

4. Skipping a Test Drive or Inspection

Never buy a truck without a thorough test drive. For used trucks, a pre-purchase inspection by an independent mechanic is non-negotiable. This can uncover hidden issues that could lead to costly repairs down the line, affecting your overall financial stability.

5. Falling for High-Pressure Sales Tactics

Salespeople are trained to close deals. Don’t let yourself be rushed into a decision you’re not comfortable with. Take your time, ask questions, and be prepared to walk away if the deal doesn’t feel right. Patience is your ally in securing the best terms.

The Truck Buying Journey: A Step-by-Step Guide

With a solid understanding of financing, let’s outline the ideal path to acquiring your truck. Following these steps will streamline the process and lead to a successful purchase.

1. Assess Your Needs and Budget

Before looking at any trucks, clearly define what you need the truck for (towing, off-roading, daily commute) and how much you can truly afford monthly. This initial step grounds your search in reality.

2. Research Trucks and Prices

Once your needs are clear, research models that fit. Compare features, reliability ratings, and average market prices for both new and used options. This armors you with valuable information for negotiations.

3. Get Your Finances in Order (Credit Check, Pre-Approval)

Check your credit score and history. Dispute any inaccuracies. Then, apply for pre-approval from at least 2-3 different lenders (banks, credit unions, online). This gives you your best interest rate and a clear maximum loan amount.

4. Shop for the Best Deal

Visit dealerships and private sellers. Negotiate the truck’s price separately from the financing. With your pre-approval in hand, you can confidently discuss the vehicle’s cost first.

5. Negotiate and Finalize

Once you agree on a price, present your pre-approved financing. See if the dealership can beat it. Read all contracts carefully before signing. Understand every fee and term. Don’t be afraid to ask for clarifications on anything you don’t understand.

Pro Tips for Smart Truck Financing

To truly master the art of purchasing a truck, here are a few extra pearls of wisdom from years in the industry.

Read the Fine Print

Every loan agreement has fine print for a reason. Don’t gloss over it. Understand penalty clauses, late payment fees, early payoff options, and any other specific terms. Ignorance is not bliss when it comes to contracts.

Don’t Forget Insurance

Get insurance quotes before you finalize your truck purchase. Premiums can vary wildly based on the vehicle type, your driving history, and your location. A surprisingly high insurance premium can quickly negate a good monthly payment.

Consider Maintenance Costs

Some trucks are notoriously more expensive to maintain than others. Research common issues and average repair costs for the models you’re considering. Factor these potential expenses into your long-term budget. A reliable vehicle saves money in the long run.

The Power of Negotiation

Everything is negotiable: the truck’s price, your trade-in value, and even the interest rate (to some extent). Be polite but firm. Do your homework and be prepared to walk away if the deal isn’t favorable. Your patience and preparedness are your greatest assets.

Your Path to Affordable Truck Ownership Starts Here

Navigating the world of trucks for sale monthly payments doesn’t have to be a mystery. By understanding the core factors that influence your payments, exploring various financing options, and applying smart strategies, you can secure a deal that perfectly aligns with your financial goals. Remember, knowledge is power, and taking a proactive, informed approach will ultimately lead to a more satisfying and sustainable truck ownership experience.

So, take a deep breath, arm yourself with this guide, and confidently embark on your journey to find the perfect truck with payments you can comfortably manage. Your dream ride awaits!