Unlocking the Dream: Can You Really Find a Ford F-150 Lease for $199 Near You? The Ultimate Guide

Unlocking the Dream: Can You Really Find a Ford F-150 Lease for $199 Near You? The Ultimate Guide Lmctruck.Guidemechanic.com

The allure of a brand-new Ford F-150, America’s best-selling truck, with a surprisingly low monthly payment, is incredibly strong. Imagine cruising in a powerful, versatile pickup for just $199 a month. It sounds almost too good to be true, doesn’t it? Many prospective truck owners dream of finding a Ford F-150 lease for $199 near me, a deal that seems to offer incredible value without the long-term commitment of ownership.

This aspiration is not just a fantasy, but it does come with specific conditions and nuances. As an expert blogger and professional SEO content writer, I’m here to tell you that while these deals are certainly possible, they are often conditional and require a keen eye for detail. This comprehensive guide will equip you with the knowledge and strategies needed to navigate the world of truck leasing, helping you understand what it truly takes to potentially secure such an attractive offer. We’ll delve into the fine print, highlight the hidden costs, and provide actionable tips to help you find the best possible deal in your local area.

Unlocking the Dream: Can You Really Find a Ford F-150 Lease for $199 Near You? The Ultimate Guide

The Allure of the $199 Ford F-150 Lease: Is It Real?

The idea of leasing a robust Ford F-150 for just $199 per month captures the imagination of many. This specific price point is incredibly attractive because it positions a premium, highly capable vehicle within a budget typically associated with smaller, less powerful cars. Manufacturers and dealerships often use these eye-catching figures in their marketing to draw customers in, knowing that such a low entry price will generate significant interest.

While a $199 monthly lease payment for an F-150 is indeed achievable, it’s crucial to approach these offers with realistic expectations. These deals are not universally available for every F-150 model or for every buyer. They are usually tied to specific configurations, credit requirements, and often require a significant down payment or other upfront costs. Understanding these underlying factors is the first step in your journey to finding such a deal. The "near me" aspect is also vital, as regional promotions and inventory levels play a huge role in what’s available locally.

Decoding the Fine Print: What Goes into a $199 Lease?

To truly understand how a $199 monthly payment for a Ford F-150 lease can exist, we need to break down the key components that determine any lease payment. Lease calculations are intricate, involving several variables that fluctuate based on the vehicle, the market, and your financial standing. Ignoring these factors can lead to surprises down the road.

Key Factors Influencing Lease Payments:

- MSRP (Manufacturer’s Suggested Retail Price): This is the sticker price of the vehicle. A lower MSRP, typically associated with base models or less popular configurations, directly translates to lower lease payments. When aiming for a $199 payment, you’re almost certainly looking at an entry-level F-150.

- Residual Value: This is the projected value of the vehicle at the end of the lease term. A higher residual value means you’re depreciating less of the car’s value over the lease period, resulting in lower monthly payments. The F-150 generally holds its value well, which can be beneficial for leasing.

- Money Factor: This is essentially the interest rate on your lease, expressed as a very small decimal. A lower money factor means less cost for financing the lease. Your credit score significantly impacts the money factor you’re offered.

- Down Payment / Capitalized Cost Reduction: This is the upfront cash you pay at the start of the lease to reduce the total amount being financed. A larger down payment directly lowers your monthly payments. This is often a critical component of achieving those very low advertised rates.

- Lease Term: The duration of your lease, typically 24, 36, or 39 months. Shorter terms might sometimes have slightly higher payments due to faster depreciation, but can also align with special manufacturer incentives. Longer terms often spread the depreciation over more months, potentially lowering the payment, but you’ll be driving an older vehicle for longer.

- Mileage Allowance: Leases come with annual mileage limits (e.g., 10,000, 12,000, or 15,000 miles per year). A lower mileage allowance often corresponds to a lower monthly payment because the vehicle is expected to have less wear and tear and a higher residual value. This is a common area where low lease payments are achieved.

- Location (Taxes, Fees): State and local taxes, as well as registration and title fees, vary significantly by region. These costs are rolled into your lease payment or due at signing, impacting your total outlay.

Common Scenarios for Low Payments:

Based on my experience, achieving a Ford F-150 lease for $199 near me usually involves a specific combination of these factors. You’ll most likely be looking at a base model F-150, such as an XL or XLT trim, often with a 2-wheel-drive configuration and a regular or SuperCab body style. These are the most affordable F-150 variants, making them prime candidates for aggressive lease promotions.

Furthermore, these deals often require a substantial down payment, sometimes ranging from $2,000 to $4,000 or even more, due at signing. This upfront capital reduces the amount you’re financing, bringing down the monthly cost significantly. Another common characteristic is a lower annual mileage allowance, typically 10,000 miles per year. If you drive more than that, the low monthly payment might quickly be offset by excess mileage fees at the end of the lease. Finally, these rates are almost always reserved for individuals with exceptional credit scores, often referred to as "Tier 1" credit, indicating a low risk to the leasing company.

Your Quest for the $199 Ford F-150 Lease Near Me: A Step-by-Step Guide

Finding that elusive $199 Ford F-150 lease requires a strategic approach and diligent research. It’s not about waiting for the deal to come to you, but actively seeking it out.

Step 1: Research, Research, Research! Unearthing Local Deals

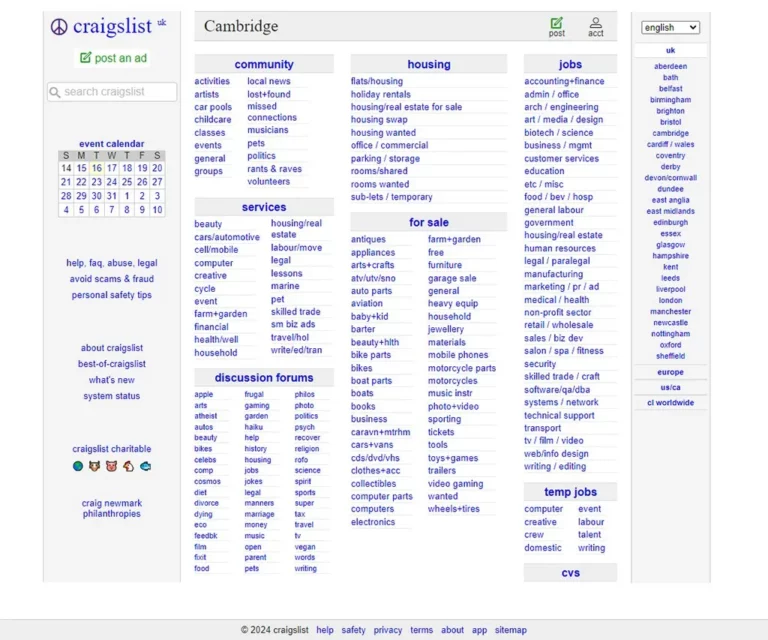

The internet is your most powerful tool in this initial phase. Start by exploring major automotive websites that aggregate lease deals, such as Edmunds, TrueCar, or Kelley Blue Book. These platforms often highlight national and regional promotions. However, for truly localized offers, you must directly check the websites of multiple Ford dealerships near you. Many dealerships post their current lease specials, often featuring specific VINs or stock numbers.

Pro tip from us: When you begin your online search, consider using an incognito or private browsing window. This can sometimes help you avoid tracking cookies that might influence the offers you see, ensuring you’re getting a fresh look at available promotions. Don’t forget to check local newspaper ads or direct mail flyers, as some hyper-local deals might still be advertised through traditional channels.

Step 2: Understand Your Credit Score – Your Financial Passport

Your credit score is arguably the most critical factor in securing a favorable lease deal. Leasing companies rely heavily on your creditworthiness to determine the money factor (interest rate) they offer and whether you even qualify for their best rates. A "Tier 1" credit score, generally above 720-740, is almost always a prerequisite for the lowest advertised monthly payments.

Common mistakes to avoid are not checking your credit score before visiting a dealership. Get a copy of your credit report from one of the major bureaus (Equifax, Experian, TransUnion) well in advance. This allows you to identify and dispute any errors and gives you a realistic understanding of your financial standing. Knowing your score empowers you in negotiations and helps you set realistic expectations for what you can achieve.

Step 3: Be Flexible with Trims and Options – Simplicity is Key

When aiming for a $199 monthly payment, flexibility with the truck’s specifications is paramount. The lowest lease payments are almost exclusively tied to base model F-150s. This means you’ll likely be looking at an XL or XLT trim, possibly with a regular cab, 2WD, and the standard engine option. Adding popular features like a larger touchscreen, premium wheels, or advanced driver-assistance systems will quickly elevate the MSRP, and consequently, your monthly lease payment.

Understand that a heavily optioned Lariat, King Ranch, or Platinum trim will not be available at this price point. Embrace the practicality of a base model if the low monthly payment is your primary goal. Focus on what you need in a truck, rather than every desired luxury.

Step 4: Timing is Everything – The Calendar is Your Ally

Dealerships and manufacturers operate on sales quotas, and your timing can significantly influence the deals available. Towards the end of the month, quarter, or especially the end of the year, dealerships are often more eager to meet their sales targets. This urgency can translate into more aggressive lease specials as they try to move inventory.

Based on my experience, new model year introductions are another prime opportunity. When the latest F-150 models hit the dealerships, older model year inventory often sees substantial lease incentives to clear them out. Keep an eye out for major holiday sales events like Presidents’ Day, Memorial Day, Black Friday, and year-end clearances. Manufacturers often sweeten their deals with additional rebates and incentives during these periods.

Step 5: Contact Multiple Dealerships "Near Me" – Fueling Competition

Once you have a clear idea of the specific F-150 configuration you’re targeting and your credit standing, it’s time to reach out to multiple Ford dealerships in your local area and even slightly beyond. Don’t limit yourself to just one. By contacting several dealers, you create a competitive environment, encouraging them to offer their best possible lease terms to earn your business.

Pro tip: When requesting quotes, be specific about the model, trim, mileage allowance, and lease term you’re interested in. Ask for a detailed breakdown of the monthly payment, the total due at signing, and the money factor. Always get these quotes in writing, via email, so you have documented proof for comparison. Sometimes, traveling an extra 30-60 miles can unlock significantly better deals, so don’t be afraid to broaden your search radius.

Step 6: The Negotiation Game – Beyond the Monthly Payment

Many people make the common mistake of focusing solely on the monthly lease payment. While it’s important, it’s not the only number to negotiate. The underlying selling price of the vehicle (often called the "capitalized cost") is the foundation of your lease. Negotiate this price as if you were buying the truck outright. A lower capitalized cost directly translates to lower depreciation and, therefore, a lower monthly payment.

Understand the money factor (interest rate) and residual value. While residual values are usually set by the leasing company and are non-negotiable, a dealer might have some flexibility on the money factor, especially if your credit is excellent. Don’t be shy to ask about all the components of the lease. Knowledge is power during negotiations.

Step 7: Read Every Single Line of the Lease Agreement – No Surprises

This cannot be stressed enough. Before signing anything, meticulously read the entire lease agreement. It’s a legally binding document, and understanding every clause is crucial. Look for details on hidden fees, such as acquisition fees, disposition fees (charged at the end of the lease), and early termination penalties. Pay close attention to the excess wear and tear clauses and the per-mile charges for exceeding your mileage allowance.

Common mistakes to avoid are rushing through this step or assuming everything is standard. If you don’t understand something, ask for clarification. Don’t be pressured into signing until you are completely comfortable with every aspect of the agreement.

Beyond the Monthly Payment: Hidden Costs and Important Considerations

While a $199 monthly payment sounds fantastic, it’s only one piece of the financial puzzle. Several other costs are typically associated with leasing a vehicle, and neglecting to factor them in can lead to budget surprises.

- Down Payment / Due at Signing: As mentioned, many advertised low monthly payments are contingent on a significant upfront payment. This "due at signing" amount often includes your first month’s payment, acquisition fee, taxes, and various other charges, in addition to any capitalized cost reduction. It could easily be several thousand dollars.

- Acquisition Fee: This is a fee charged by the leasing company for setting up the lease. It’s usually a few hundred dollars and can either be paid upfront or rolled into your monthly payments, increasing them slightly.

- Taxes and Registration Fees: These vary widely by state and locality and can be substantial. Some states tax the entire capitalized cost of the vehicle, while others only tax the monthly payment. Ensure you understand how these are applied in your area.

- Excess Mileage Fees: This is one of the most common pitfalls of leasing. If you exceed your annual mileage allowance, you’ll pay a penalty for every extra mile, often ranging from $0.15 to $0.25 per mile. These fees can quickly accumulate, negating any savings from a low monthly payment.

- Excess Wear and Tear: Leasing companies expect the vehicle to be returned in good condition, allowing for "normal" wear and tear. However, dings, dents, scratches, stained interiors, or worn tires beyond what’s deemed normal can incur significant charges at lease end. Pro tip: Always budget for potential minor repairs or invest in a wear and tear waiver if available and cost-effective.

- Disposition Fee: This fee, typically a few hundred dollars, is charged by the leasing company when you return the vehicle at the end of the lease. It covers the cost of preparing the car for resale.

- Insurance Costs: Leased vehicles generally require higher insurance coverage, including comprehensive and collision, to protect the leasing company’s asset. Always get an insurance quote for the specific F-150 model you’re considering before finalizing your lease. This can be a substantial ongoing cost.

Factoring in all these costs – upfront, monthly, and potential end-of-lease expenses – gives you a true picture of the total cost of your Ford F-150 lease $199 near me.

Lease vs. Buy: Is Leasing Right for Your F-150 Dream?

Deciding whether to lease or buy your Ford F-150 is a significant financial decision, each path offering distinct advantages and disadvantages. Understanding these differences is crucial for making the choice that best suits your lifestyle and financial goals.

Advantages of Leasing:

- Lower Monthly Payments: This is often the primary draw, as lease payments are typically lower than loan payments for the same vehicle because you’re only paying for the depreciation during the lease term, not the entire purchase price.

- Always Driving a New Vehicle: With a lease, you can drive a new F-150 every few years, enjoying the latest technology, safety features, and designs.

- Manufacturer Warranty Coverage: Leased vehicles are almost always under the manufacturer’s warranty for the entire lease term, minimizing unexpected repair costs.

- No Trade-In Hassle: At the end of the lease, you simply return the vehicle to the dealership (after paying any disposition fees and addressing excess wear/mileage). You avoid the complexities of selling a used vehicle or negotiating a trade-in.

- Tax Benefits for Businesses: For business owners, lease payments can often be tax-deductible, offering a financial advantage.

Disadvantages of Leasing:

- No Equity Building: You don’t own the vehicle and therefore don’t build equity. All your payments contribute to the use of the vehicle, not its ownership.

- Mileage Restrictions: As discussed, strict mileage limits can be a major drawback for high-mileage drivers, leading to costly penalties.

- Wear and Tear Penalties: Any damage beyond "normal" can result in additional charges at lease end.

- Early Termination Penalties: Breaking a lease early can be extremely expensive, often requiring you to pay the remaining payments and additional fees.

- You Don’t Own the Vehicle: You cannot customize the truck, and you don’t have the freedom of ownership that comes with buying.

Consider your typical driving habits: do you drive many miles annually? Are you meticulous about vehicle care? Do you prefer always having a new vehicle, or do you value building equity and long-term ownership? Your answers will help guide your decision for an F-150. For a deeper dive into understanding credit scores and how they impact auto loans and leases, explore our detailed guide on on our blog.

Alternatives to the $199 F-150 Lease

If after reviewing all the conditions, you find that the Ford F-150 lease $199 near me doesn’t quite fit your needs or budget, don’t despair! There are several excellent alternatives to consider for getting into a capable pickup.

- Buying Used: Purchasing a pre-owned Ford F-150 can offer significant savings. You avoid the rapid depreciation of a new vehicle, have no mileage restrictions, and can build equity. A slightly older model, perhaps 2-3 years old, can provide nearly all the benefits of a new truck at a much lower cost. If you’re weighing other options, we also have a comprehensive breakdown of ‘Buying a Used Truck: What You Need to Know’ available on our blog.

- Exploring Other Truck Models: While the F-150 is iconic, competitors like the Ram 1500, Chevrolet Silverado, GMC Sierra, or even mid-size trucks like the Ford Ranger or Toyota Tacoma might offer more aggressive lease deals or lower purchase prices, especially on base models. Sometimes, a manufacturer might be pushing sales on a particular model, leading to unexpected bargains.

- Older F-150 Model Years: Dealerships sometimes offer very attractive lease or financing deals on previous model year F-150s that are still new. These vehicles are identical to the current year’s model but can come with substantial discounts as dealers aim to clear inventory.

- Slightly Higher Payment for Better Trim: If the base model F-150 doesn’t meet your essential needs (e.g., you need 4WD or a specific cab configuration), consider if a slightly higher monthly payment, perhaps $250-$300, opens up more suitable options. Sometimes a small increase in payment can bring a significant improvement in features or capability.

Remember, the goal is to find the best value for your specific situation. Don’t limit your options if the advertised $199 lease doesn’t align with your requirements.

Conclusion: Your Path to a Ford F-150 Lease

The dream of securing a Ford F-150 lease for $199 near me is indeed within reach, but it requires a combination of diligent research, realistic expectations, and smart negotiation. As we’ve explored, these highly attractive offers are typically tied to specific base models, excellent credit scores, a considerable down payment, and strict mileage limitations. Understanding these underlying conditions is key to transforming a marketing headline into a tangible deal.

Your quest begins with thorough online research, checking local dealership websites, and understanding your creditworthiness. Be prepared to be flexible with vehicle configurations and timing, as these elements can significantly impact the availability and cost of lease specials. Most importantly, read every line of the lease agreement and factor in all associated costs, not just the monthly payment, to ensure there are no surprises.

By empowering yourself with this comprehensive knowledge, you can approach the leasing process with confidence, making an informed decision that truly meets your needs and budget. So, start your research today, compare offers from multiple Ford dealers in your area, and drive away in your dream Ford F-150. For official specifications and current manufacturer offers on the Ford F-150, you can always visit the official Ford website.