Dump Trucks For Sale No Credit Check: Your Ultimate Guide to Acquiring Heavy Haulers Without Financial Roadblocks

Dump Trucks For Sale No Credit Check: Your Ultimate Guide to Acquiring Heavy Haulers Without Financial Roadblocks Lmctruck.Guidemechanic.com

The rumble of a dump truck at work is the sound of progress. For many entrepreneurs, owner-operators, and construction businesses, owning one of these robust machines is essential. It represents the ability to take on more jobs, expand operations, and drive revenue. However, the path to acquiring a dump truck can often be blocked by a significant hurdle: traditional financing and credit checks.

For those with a less-than-perfect credit history, or perhaps a new business with no credit history at all, the prospect of securing a loan can seem daunting. The good news? The dream of owning a dump truck doesn’t have to remain out of reach. In this comprehensive guide, we’ll delve deep into the world of "dump trucks for sale no credit check," exploring viable avenues and equipping you with the knowledge to make an informed decision. Our goal is to empower you to navigate this specialized market with confidence, ensuring you find the right heavy hauler to propel your business forward.

Dump Trucks For Sale No Credit Check: Your Ultimate Guide to Acquiring Heavy Haulers Without Financial Roadblocks

Understanding the "No Credit Check" Landscape for Dump Trucks

When you see "no credit check" advertised, it’s natural to be curious, and perhaps a little skeptical. In the context of heavy equipment like dump trucks, "no credit check" rarely means zero evaluation of your financial standing. Instead, it signifies that traditional credit scores (FICO, VantageScore) might not be the primary, or even a major, determinant in the approval process.

Traditional lenders heavily rely on credit scores to assess risk. A low score or a thin credit file can instantly lead to rejection or exorbitant interest rates. However, alternative financing solutions for dump trucks shift their focus. They look at other indicators of your ability to pay, such as consistent income, business assets, and the value of the equipment itself.

The market demand for "no credit check" options is significant. Many hardworking individuals and growing businesses have strong operational cash flow and solid business plans but have faced past financial setbacks or are too new to establish a robust credit history. These options provide a crucial lifeline, allowing them to invest in essential equipment and contribute to the economy.

Who Benefits from "No Credit Check" Dump Truck Options?

The appeal of acquiring a dump truck without stringent credit scrutiny extends to a diverse group of buyers. Understanding if you fall into one of these categories can help you determine if this path is right for you.

Firstly, start-up businesses with no established credit history are prime candidates. New ventures often struggle to secure traditional financing because they lack the track record that banks typically demand. "No credit check" options allow them to acquire necessary assets without waiting years to build credit.

Secondly, entrepreneurs with past financial difficulties or a "bad credit" score find these options invaluable. Life happens, and a bankruptcy, foreclosure, or a series of late payments shouldn’t permanently derail your business aspirations. These alternative routes offer a second chance based on current financial stability and future potential.

Thirdly, individuals seeking quick approvals without lengthy credit reviews can benefit immensely. Traditional loan applications can be time-consuming, involving extensive paperwork and prolonged waiting periods. When you need a dump truck quickly to seize a job opportunity, streamlined "no credit check" processes can be a game-changer.

Finally, some established businesses or individuals might opt for these methods to preserve existing credit lines. By not tapping into their traditional credit for equipment purchases, they keep those lines open for other operational needs or emergencies, offering greater financial flexibility.

Exploring Viable "No Credit Check" Dump Truck Acquisition Methods

Acquiring a dump truck without a stellar credit score requires exploring less conventional, but highly effective, financing methods. Based on my extensive experience in the heavy equipment financing sector, these are the most common and accessible paths. Each comes with its own set of advantages and considerations.

Method 1: Lease-to-Own / Rent-to-Own Programs

Lease-to-own, often referred to as rent-to-own, is arguably one of the most accessible routes for acquiring dump trucks for sale with no credit check. This method functions much like renting the equipment with the eventual option to purchase it. You make regular payments over a specified period, and a portion of each payment typically goes towards the eventual purchase price.

The beauty of this model is its flexibility and lower upfront barriers. You get immediate access to the dump truck, allowing you to put it to work and generate income right away. Many programs are structured to allow you to build equity with each payment, effectively building your creditworthiness with the lessor as you demonstrate responsible payment behavior.

However, it’s crucial to understand the nuances. While you gain operational use, you don’t fully own the asset until the lease term is complete and the final purchase option is exercised. The total cost over the lease period can sometimes be higher than a traditional purchase with a loan, reflecting the added risk the lessor takes. Always scrutinize the contract for balloon payments, residual values, and early buyout options.

Method 2: Owner Financing / Seller Financing

Owner financing, or seller financing, involves purchasing a dump truck directly from the current owner, who then acts as the lender. Instead of getting a loan from a bank, you make payments directly to the seller based on agreed-upon terms. This method often bypasses traditional credit checks entirely, as the agreement is purely between you and the seller.

Pro tips from us: This option offers incredible flexibility in terms, interest rates, and payment schedules, as everything is negotiable. It can be particularly effective when buying a used dump truck from an individual or a small business looking to liquidate assets quickly. You might secure a better deal and more favorable terms than through a large institution.

However, a common mistake to avoid is not formalizing the agreement. Always ensure you have a comprehensive, legally binding contract drafted by a professional. This document should clearly outline the purchase price, interest rate, payment schedule, default clauses, and transfer of title. Without proper legal documentation, both parties are vulnerable to misunderstandings and disputes.

Method 3: Equipment Dealers Specializing in "Second Chance" Financing

A growing number of equipment dealers understand the challenges faced by buyers with credit issues. These specialized dealerships often have in-house financing departments or established relationships with alternative lenders who prioritize factors other than a perfect FICO score. They are often your best bet when searching for "dump trucks for sale no credit check."

These dealers typically look at your down payment capability, your business’s cash flow, and your industry experience. They want to see that you have a viable plan to generate income with the dump truck. While they might still run a "soft" credit pull (which doesn’t impact your score) or ask for bank statements, their approval criteria are significantly more lenient than traditional banks.

From an expert’s perspective, this can be a convenient and often efficient way to acquire a dump truck. They can offer tailored solutions, sometimes including lease-purchase options or specialized loan products. However, be prepared for potentially higher interest rates or larger down payment requirements compared to prime lending rates, reflecting the increased risk these lenders assume.

Method 4: Hard Money Lenders / Asset-Based Lending (Use with Caution)

Hard money lenders operate differently; they primarily focus on the collateral backing the loan, rather than the borrower’s credit score. If you have other valuable assets (real estate, other heavy equipment) that you’re willing to pledge as collateral, a hard money lender might offer financing for a dump truck. The dump truck itself can also serve as the primary collateral.

The main advantage here is speed. Approvals can be incredibly fast, often within days, making it suitable for urgent acquisitions. However, this is where the caution comes in. Hard money loans typically come with very high interest rates and short repayment terms. The risk of losing your collateral if you default on payments is significant.

Based on my experience, this option should generally be considered a last resort. It’s best suited for experienced business owners who have a clear, short-term plan to repay the loan quickly or those who can demonstrate exceptionally strong cash flow to manage the high payments. Thoroughly assess the risks before pursuing this path.

Method 5: Peer-to-Peer Lending (for Down Payments or Smaller Purchases)

While less common for the full purchase of heavy equipment like dump trucks, peer-to-peer (P2P) lending platforms can sometimes be a viable option for securing a down payment or for purchasing a smaller, less expensive used dump truck. These platforms connect individual lenders directly with borrowers, often bypassing traditional banking institutions.

Credit requirements on P2P platforms can be more flexible than banks, as individual lenders may prioritize different factors. However, for a significant purchase like a dump truck, you might find that the loan amounts offered are insufficient or the interest rates are still tied to some form of credit assessment. It’s worth exploring if you only need a portion of the financing or have a strong business case to present to potential lenders.

Key Factors to Consider Beyond Credit Score

When traditional credit scores take a backseat, other aspects of your financial and operational health come into sharper focus. Understanding and strengthening these areas will significantly improve your chances of securing a dump truck for sale with no credit check.

First and foremost is your down payment. A substantial down payment reduces the lender’s risk and demonstrates your commitment. The more cash you can put down upfront, the more attractive you become to alternative lenders, often leading to better terms.

Next, a solid business plan and demonstrable revenue are critical. Lenders want to see how you intend to generate income with the dump truck and how that income will cover your payments. Provide bank statements, existing contracts, and projections that clearly show your ability to pay.

Collateral plays a significant role. If you have other assets—be it real estate, other vehicles, or existing equipment—that you can offer as additional security, it can strengthen your application. This reassures lenders that their investment is protected.

Your industry experience also carries weight. If you can demonstrate a proven track record in the trucking, construction, or hauling industry, it shows you understand the business and are likely to succeed. This reduces the perceived risk for lenders.

Finally, the condition and value of the dump truck itself are always a consideration. A well-maintained, reliable truck holds its value better and is easier to repossess and resell if things go south, making it a more appealing asset for lenders to finance.

The Due Diligence Checklist Before You Buy

Acquiring a dump truck, especially through alternative financing, requires meticulous due diligence. This is not just about protecting your investment but also ensuring the longevity and profitability of your operations.

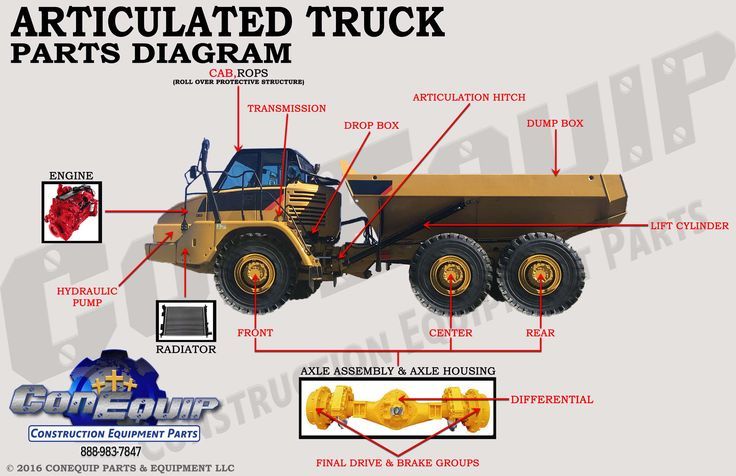

Thorough Inspection of the Dump Truck (Pre-Purchase Inspection – PPI): Never buy a heavy equipment vehicle without a comprehensive inspection by a qualified, independent mechanic. This goes beyond a visual check. They should assess the engine, transmission, hydraulic system, brakes, frame, tires, and all operational components. A good PPI can save you thousands in unexpected repairs.

Reviewing the Vehicle History Report: For commercial vehicles, services similar to CARFAX exist that can provide a detailed history of the truck. This report can reveal past accidents, major repairs, odometer discrepancies, flood damage, and title issues. This transparency is vital for understanding the true condition and value of the dump truck.

Understanding All Terms & Conditions: This cannot be stressed enough. Read every line of the contract. Pay close attention to the interest rate (APR), the total amount payable, late payment penalties, default clauses, maintenance responsibilities, and any hidden fees. If anything is unclear, ask for clarification.

Getting Legal Advice: Before signing any contract, especially for owner financing or lease-to-own agreements, have a qualified attorney review the document. They can identify unfavorable clauses, protect your interests, and ensure the agreement is legally sound and enforceable.

Comparing Multiple Offers: Don’t jump at the first "no credit check" offer you receive. Shop around. Contact several specialized dealers, explore various lease-to-own programs, and even inquire with private sellers. Comparing terms, rates, and conditions will help you secure the best possible deal.

Maximizing Your Chances of Approval (Even Without Perfect Credit)

Even with "no credit check" options, lenders and sellers are looking for reliable partners. You can significantly boost your approval odds by proactively addressing key areas.

First, build a strong down payment. This is your most powerful tool. The more capital you can invest upfront, the less risk the lender assumes, making you a much more attractive borrower. Start saving aggressively if you’re serious about this path.

Second, show proof of consistent income and existing contracts. Demonstrate that you have a steady stream of revenue or confirmed jobs that will utilize the dump truck. Presenting a solid portfolio of work or letters of intent from clients can be very persuasive.

Third, improve your business fundamentals. Even if your personal credit is challenged, a well-structured, organized business with clear financial records will impress. This includes having a dedicated business bank account, clear accounting practices, and a well-thought-out business plan.

Consider finding a co-signer if possible. If you have a trusted business partner or a family member with good credit and a willingness to co-sign, it can significantly strengthen your application. Their credit history provides an additional layer of security for the lender.

Finally, consider starting small. If a brand new, top-of-the-line dump truck is out of reach, perhaps an older, well-maintained used dump truck is a more feasible starting point. Proving your ability to manage payments on a less expensive asset can build the trust needed for future, larger acquisitions. Check out our guide on to help you decide.

Pro Tips for Finding Reputable Sellers and Lenders

Navigating the "no credit check" market requires vigilance. It’s essential to partner with reputable sellers and lenders to avoid scams and ensure a fair deal.

Start by exploring online marketplaces specializing in heavy equipment. Websites like MachineryTrader.com, TruckPaper.com, and EquipmentTrader.com list numerous dump trucks and often include options from dealers who cater to various credit profiles. Be sure to use their filters for "financing options" or "seller financing."

Don’t overlook local dealerships, especially those that advertise "all credit welcome" or "second chance financing." Visit their lots, speak with their sales and finance teams, and get a feel for their customer service and transparency. Local connections can be invaluable for after-sale support as well.

Networking within the industry can also yield excellent leads. Talk to other owner-operators, contractors, and mechanics. They often have firsthand experience with specific dealers or private sellers and can offer recommendations or warnings.

Always check reviews and testimonials for any seller or lender you’re considering. Online platforms like Google Reviews, Yelp, and industry-specific forums can provide insights into their reputation, customer satisfaction, and ethical practices. A pattern of negative reviews, especially regarding financing terms or vehicle quality, should be a red flag.

Lastly, for business resources and potential grants that might assist with down payments or initial operating costs, consider consulting trusted external sources like the Small Business Administration (SBA) website at SBA.gov. While they primarily deal with traditional loans, their resources on business planning and management are invaluable for any entrepreneur.

Common Mistakes to Avoid When Seeking "No Credit Check" Options

While the "no credit check" path offers incredible opportunities, it’s also fraught with potential pitfalls. Being aware of these common mistakes can save you significant time, money, and headaches.

One of the most frequent errors is rushing into a deal. The urgency to acquire equipment can sometimes cloud judgment, leading buyers to accept unfavorable terms or overlook critical details. Take your time, compare offers, and never feel pressured to sign on the spot.

Another critical mistake is ignoring the fine print. As mentioned, these contracts can be complex. Assumptions about interest rates, hidden fees, or maintenance responsibilities can lead to costly surprises down the line. Always read everything carefully and seek professional clarification.

Many buyers also overlook ongoing maintenance costs. A dump truck is a heavy-duty machine that requires regular servicing, parts replacement, and occasional repairs. Factor these operational expenses into your budget from day one. For more insights into , read here.

Furthermore, underestimating operational expenses beyond maintenance can be detrimental. Fuel costs, insurance, licensing, permits, and potential driver wages all add up. Ensure your business plan accounts for all these variables, not just the truck payment.

Finally, dealing with unverified or unreputable sellers is a major risk. Always verify the seller’s identity, legitimacy, and the truck’s ownership. Scammers often target buyers seeking "no credit check" options, so extreme caution is warranted.

Conclusion

The journey to acquiring a dump truck, especially when navigating the complexities of "no credit check" financing, can seem challenging. However, as this comprehensive guide has shown, it is absolutely achievable. By understanding the alternative financing methods available, focusing on what lenders truly value beyond a credit score, and exercising diligent research, you can unlock the door to heavy equipment ownership.

Remember, the goal is not just to acquire a dump truck, but to acquire the right dump truck on favorable terms that support your business’s growth and profitability. Take the time to prepare, ask the right questions, and don’t be afraid to walk away from a deal that doesn’t feel right. With persistence, smart planning, and careful execution, you can secure the vital equipment you need to build your business and pave your path to success. The road ahead may have its challenges, but with the right dump truck and a clear vision, you’re ready to haul.